Request Information About Personal & Family Financial Planning

Please click here for Prospective Graduates

Minoring in Personal & Family Financial Planning

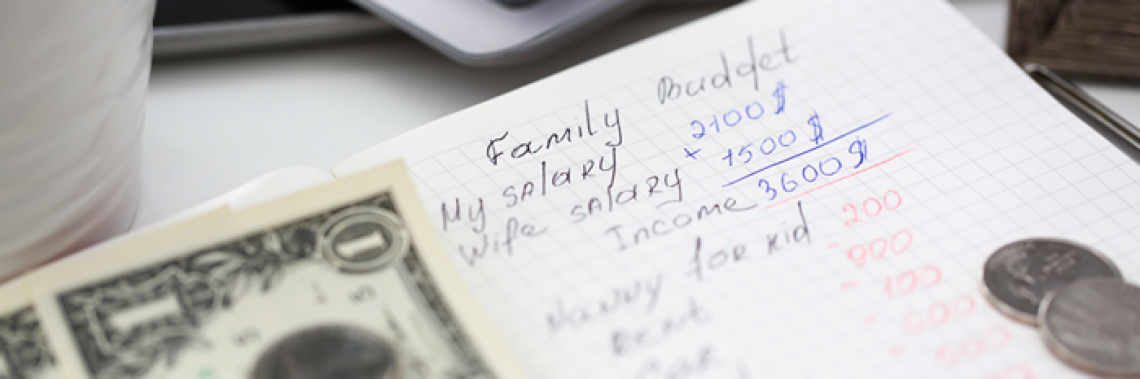

If you’re curious about how personal beliefs, values and lifestyle work in tandem to influence how people save, budget and invest — and what your role can be in helping them prepare for the future — consider partnering your major with a minor in Personal & Family Financial Planning.

Topics of Study

- Estate Planning

- Financial Planning

- Retirement Planning

- Tax Planning

- Wealth Management

- Client Services

- Financial Services

Sample Courses

- PFFP 315: Applied Personal & Family Income Tax Planning

- PFFP 402: Personal & Family Estate Planning

- PFFP 403: Retirement Savings & Family Income Strategies

Minor Requirements

The first six PFFP minor classes must be completed before PFFP 498 (Capstone)

There are no prerequisites for the first six classes. However, if a student has not taken an accounting class or does not have experience working in a financial field, it is highly recommended that they take HECL 302 or PFFP 302 prior to taking the PFFP classes.

Elevate Your Education

Make an appointment with an adviser to learn about all the ways that a minor in Personal & Family Financial Planning can benefit your main course of study.